The Social Security has presented a revised proposal for the Contributions of self-employed workers for 2026. This proposal establishes the most likely planning scenario for the next financial year. The final regulation must still be approved and published in the BOE.

The main change is the freeze of bases and contributions for self-employed workers with lower earnings. The other brackets will see a very moderate increase, only between 1% and 2.5% of the base.

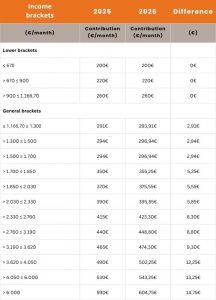

RETA Table: Contributions (or Fees) 2026 vs. 2025

This table details the proposal for the minimum bases and monthly contributions of the Special Regime for Self-Employed Workers (RETA) for 2026.

Observation: The maximum increase in the proposed contribution is €14.75 per month. This is due to a rise in the minimum contribution base of 2.5% for the highest earnings.

How to adjust your Contribution Base?

The contribution is based on the net earnings (or income) that the self-employed individual expects to obtain. The self-employed worker must position themselves in the income bracket that corresponds to them. Then, they must choose a contribution base within the minimum and maximum of that bracket.

The change request and the preliminary net profit report are submitted through the Import@ss portal.

Formula for Calculating Net Income

To determine the monthly net profit to specify, follow these steps:

- Calculate the annual net profit from the activity. This is income minus deductible expenses.

- Add up all the contributions (or fees) paid to the Social Security fund during the year.

- Deduct 7% for generic expenses. If you are a corporate self-employed worker (autónomo societario), deduct 3%.

- Divide the result by 12. This is the monthly net profit you must declare for your 2026 Contributions.

Deadlines for Requesting a Change to the Base

You may request and change your contribution base up to six times a year. The request must be submitted to the TGSS – Social Security. The changes will take effect on the following dates (depending on the application period):

- March 1st, if the request is submitted between January 1st and the last calendar day of February.

- May 1st, if the request is made between March 1st and April 30th.

- July 1st, if a request is made between May 1st and June 30th.

- September 1st, if the request is made from July 1st to August 31st.

- January 1st of the following year, if the request is made from November 1st to December 31st.

Please contact us for advice if you wish to perform your duties as a self-employed individual and need assistance with adjusting your Contributions.

Leave a replyОставить коментарий