Selling your property in Spain as a Non-Fiscal Resident involves a mandatory 3% withholding on the sale price. This percentage is not a final tax; rather, it is a payment on account applied by the Tax Agency (Hacienda) as a guarantee.

The objective is clear: recovering that 3% or the largest possible part of it.

Are you eligible for a refund?

You may request a full or partial refund if:

- You did not obtain a capital gain from the sale (i.e., you incurred a loss).

- The actual tax on your gain is less than the 3% that was withheld.

The Key to Getting Your Money Back

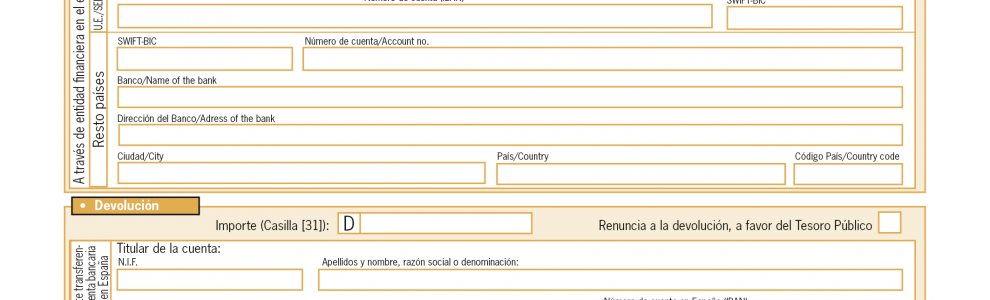

The process requires filing Form 210 with the Tax Office and providing proof of the actual gain or loss. To do this, it is crucial to properly justify the deductible expenses:

- Acquisition costs (Notary, Registry, Purchase taxes).

- Investment and home improvement expenses.

- Sale costs (Agency commission, Municipal Capital Gains Tax (Plusvalía)).

The Critical Error Regarding Deadlines

There is erroneous information circulating about the time limit. It is vital for you to know that:

- Application Deadline: You have a legal period of four years to request the refund.

- Compliance Requirement: For the refund to proceed, you must have paid the annual Non-Resident Income Tax (IRNR) throughout the entire period you owned the property.

If the documentation is not filed correctly or the deadline is missed, you will definitively lose the 3% withheld.

Don’t leave your money in the hands of Hacienda! Managing this request is technical. Errors in calculation or a lack of correct documentation are the main reasons for denial.

At Consultinfo, we specialise in taxation for Non-Resident sellers in Spain. We guarantee precise handling of Form 210 to maximise your refund and prevent demands from the Tax Agency.

Your interest is our priority.

-> Contact us today and recover your 3% with complete peace of mind.

Leave a replyОставить коментарий