Everyone wants to pay less! Moreover, when it comes to 3% of the amount for which you sold your property.

Everyone wants to save as much money as possible when selling. But in this case, you must consider the following points

- When a Non-resident sells his property, the seller withholds 3% of the sale amount specified in the deed, which he declares and pays to the Tax Office.

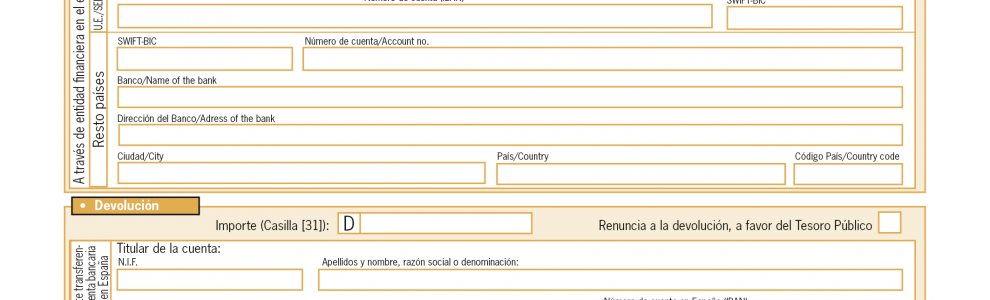

- If you sold your property without profit, then you have the opportunity to request a refund of this withheld amount, but:

you must have paid all non-resident taxes throughout the entire period of ownership of the property

The request must be made within 3 months, after a month after the transaction and signing by a notary.

To calculate this declaration for submitting a request for a return, you must take into account all the costs that you incurred at the time of purchasing this object, and you can also take into account the costs for improving housing.

Consultinfo can provide you with assistance in order for you to request this return.

After all, our slogan:

Your interests are our priority!

Leave a replyОставить коментарий